Grace period, run-out, carryover. What's the difference?

If you have a Flexible Spending Account (FSA) you may be familiar with one or more of these terms. But, do you know what they all mean? We'll break them down so you can better understand each of them and what they could mean for you. Your employer may have chosen to offer you a grace period, a run-out period, or a combination of a run-out period and carryover. You'll want to check your employer's plan document for specific details on how your plan works or you can view the member website to find the key deadlines for your account.

Find the rules for your account

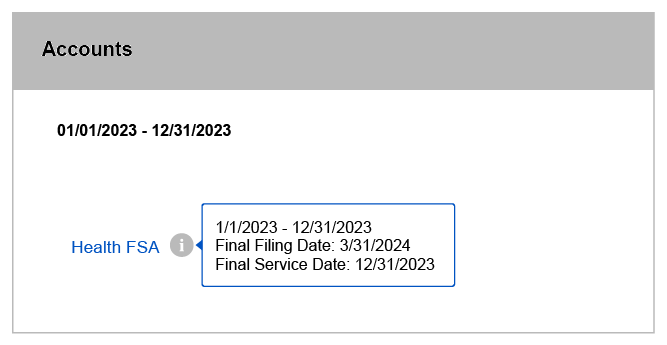

You can go to the member website to find out key dates for your account(s). On the homepage, scroll down to the Accounts section and click on the gray information icon. A pop-up screen will give you the plan year, final filing date and final service date for your account. The final filing date is the deadline for filing a claim for each plan year and the final service date is the deadline for spending money on qualified health care expenses.

Let's take a look at the year-end spending rule options

If you researched your company's benefit information, you may have found that your employer is offering you one or more of the following options. This section will help you to better understand each option and what they could mean for you.

Grace period

Grace period is extra time beyond the end of the plan year when you can use your remaining FSA balance to pay for expenses you incur (typically up to March 15 of the new year).* It basically extends the length of time you can use your FSA funds beyond the end of the plan year.

In this example, your plan year is January 1, 2023 through December 31, 2023. You have until March 15, 2024 to use the remaining funds in your FSA and until March 31, 2024 to file a claim.

*You can use your Bank of America Health Account Visa® debit card to pay for expenses during the grace period.

Plan Types: Health FSA, Limited Purpose FSA

Run-out period

Run-out allows you extra time to file a claim for expenses you incurred during the plan year. It basically extends the time to file claims for reimbursement beyond the end of the plan year, typically December 31. The run-out period typically ends on March 31* and any funds remaining in your account after that time would be forfeited.

You had a dental procedure on December 15, but you forgot to file a claim before December 31. In this case, you would still have up to March 31 to file a claim.

You cannot use your Bank of America Health and Benefit Account Visa® debit card to pay expenses for the prior plan year. You will have to file a claim on the member website or the MyHealth app to pay a provider directly or reimburse yourself for an out-of- pocket expense.

Plan types: Health FSA, Limited Purpose FSA, Dependent Care FSA

Run-out period with carryover

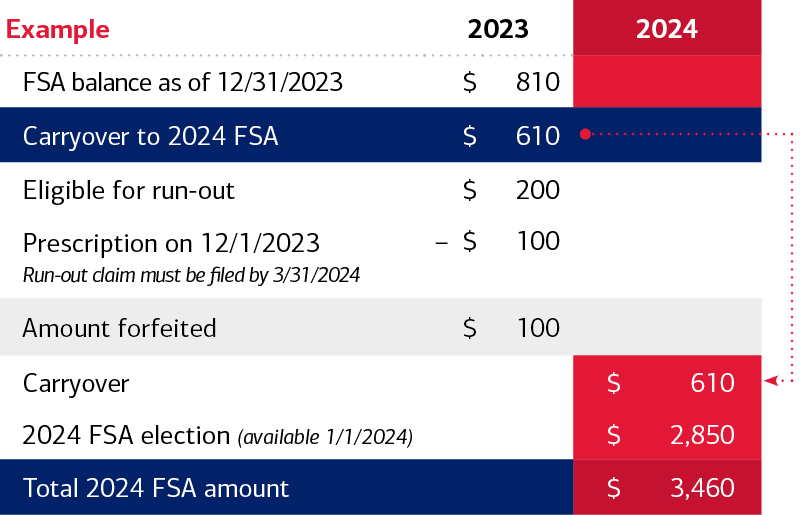

Carryover is an amount that can rollover from your current plan year and is added to your plan for the following year (up to $610*). It's common for employers to provide a combination of carryover with a run-out period. In this case, not only do you have additional time (usually up to March 31) to file claims for expenses incurred in the prior year, but you can also carry forward up to $610 of your funds and add them to your balance for next year.

*You cannot use your Bank of America Health and Benefit Account Visa® debit card to pay prior year expenses for the run-out funds. You will have to file a claim on the member website or the MyHealth app. You can, however, use your debit card for any 2024 expenses in your new plan year, including any carryover funds.

Plan Types: Health FSA, Limited Purpose FSA

Comparison chart

Comparison Chart

| |

Grace period

Grace period

|

Run-out

Run-out

|

Carryover

Carryover

|

|

What can it be used for?

|

What can it be used for?

To pay for expenses you incur up to March 15 of the new plan year

|

What can it be used for?

To pay for expenses incurred in the previous plan year

|

What can it be used for?

Expenses from the prior plan year and the new plan year

|

|

Can you use your debit card?

|

Can you use your debit card?

Yes

|

Can you use your debit card?

Cannot use for prior year expenses, you can use for expenses from the new plan year

|

Can you use your debit card?

No, you will need to file a claim on the member website or the MyHealth app

|

|

How long is it?

|

How long is it?

Can incur expenses until March 15 and then file claims up to March 31 of the new plan year

|

How long is it?

Typically March 31*

|

How long is it?

No expiration, but there is a maximum amount of $610

|

*Check your employer's plan document for specific details of your account.